Capturing the Walletshare of Gen Z

Read time 5 Minutes

In this post:

- Gen Z Wants Modern and Personalized Financial Services

- Wealth Managers Need to Think Differently About Data

- Complementing Found Data with Experimental Data

Gen Z Wants Modern and Personalized Financial Services

The youngest generation of investors thinks differently about their money. Gen Z (born 1997-2012) entered the world at the genesis of the information economy. It is innate for Zoomers to access every product, service, and piece of information they desire at the push of a button – and financial services will be no different. Zoomers demand a modern, digitally enabled investing experience.

However, this does not mean they are simply looking for digitized investing. Zoomers will not be impressed by firms who simply take their longstanding paper process and put it online. Rather, Gen Z demands highly personalized digital experiences.1 They will not accept a wealth manager built for the masses, just as they don’t use retailers, entertainment, and social media platforms built for the masses.

Fintechs are currently outpacing traditional financial services firms in the race to meet the needs of Gen Z. Fintechs are also marketing themselves creatively, zeroing in on Gen Z’s concerns, such as the climate and social consciousness, by offering specialized products that appeal to those needs.2

A June 2021 survey by EY found that 51% of Gen Z consumers name a fintech company as their most trusted financial brand, while only 23% name a national bank.3 This is especially important, as we are entering the largest intergenerational wealth transfer in history, and 80% of heirs will look for a new advisor after inheriting wealth.4

The advisors of tomorrow will be expected to have a deep understanding of each of their clients’ unique goals, preferences, and constraints. Advice must be hyper-personalized if advisors hope to retain clients and compete with cheaper hybrid and robo-advice offerings.

Wealth Managers Need to Think Differently About Data

The playbook seems straightforward.

Data-driven personalization at scale is the key to capturing the wallet-share of Zoomers, as has been demonstrated across other industries. Amazon offers highly personalized product recommendations based on previous product purchases and browsing. YouTube, Netflix, Instagram, and others do the same with content recommendations. These are examples of utilizing Found Data to understand customer preferences. Every major firm currently has access to this kind of data on their customers.

Financial services is striving to replicate this data strategy to capture the walletshare of Gen Z. However, merely aggregating user and demographic data to personalize a client’s experience in the same step as other industries will not suffice.

This is because helping clients achieve financial well-being isn’t like selling books or populating a person’s newsfeed with cat videos based on previous engagement. Transaction data in financial advice is low in quantity, as most clients infrequently trade in and out of portfolios. Relying on this kind of data alone paints an incomplete picture of the client’s preferences and forms a weak foundation for personalized advice.

A more granular and directly measured understanding of preferences is required to attract, acquire, and retain Gen Z in a low-fee advice landscape. Helping them navigate long-term savings, investments, loans, insurance, annuity, and estate planning decisions (and making those decisions stick) necessitates a new class of client data to power personalization at scale.

Complementing Found Data with Experimental Data

According to the McKinsey North American Wealth Report: 2030: “By 2030, at least 80 percent of advisors will offer goal-based advice, and about half of clients will actively pursue and track bite-sized goals…To bring goal-based advice to life and make it practical, intuitive, and actionable, advisors need to leverage behavioral-economics techniques such as gamification.”5

As we’ve discussed before in our Stated vs. Revealed Preferences blog series, gamified methods of revealing a client’s preferences, backed by behavioral-economics, give advisors the most accurate view of each of their clients’ unique preferences. Economists refer to this kind of preference data as “experimental” because it is sourced directly from consumers via artfully crafted decision scenarios.

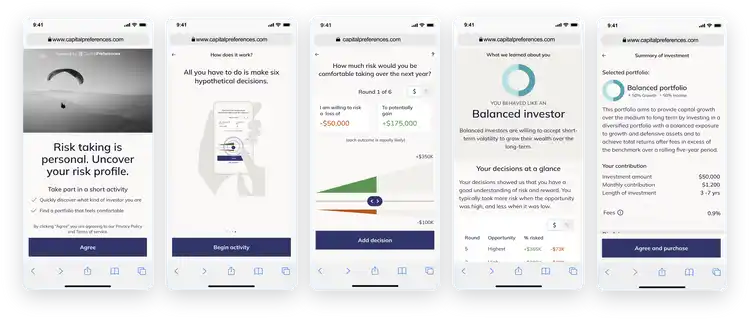

Experimental Data is recovered directly from individuals based on the decisions they make in scenarios crafted to reveal their preferences. By having clients show advisors their preferences through the decisions and tradeoffs they make in a gamified activity (as shown in the image below) advisors can confidently leverage this Experimental Data to gain critical insights about their clients.

Experimental Data also leads to higher client engagement and conversions. A 22-year-old Zoomer investing for the first time is far more likely to complete a gamified risk-tolerance activity with interactive animations and graphics than a standard risk-tolerance-questionnaire. To use an example from our work, Capital Preferences’ Risk Simulator has a 95% unaided completion rate by clients in live commercial digital acquisition journeys, and is preferred 3:1 to risk-tolerance-questionnaires when compared head to head.

To catch up to the Fintechs already positioning themselves as Gen Z’s wealth managers, traditional advisors must develop a new data strategy. They should begin by harnessing Experimental Data to capture clients’ preferences precisely and holistically in the domains of risk, social (for sustainable investing) and time (for purpose of saving/spending). This integrated view of a clients’ preferences forms the data “backbone” to deliver personalized advice at scale. Firms can then layer in Found Data where it provides additional value to personalize the client experience.

Works Cited:

[i] www.wsj.com/articles/generation-z-financial-technology-11642714326

[ii] Ibid.

[iii] https://www.ey.com/en_us/nextwave-financial-services/how-financial-institutions-can-win-the-battle-for-trust

[iv] Purposefully Personal, Crafting a High Growth ESG Experience, Capital Preferences, 2021

[v] https://www.mckinsey.com/industries/financial-services/our-insights/on-the-cusp-of-change-north-american-wealth-management-in-2030