The power of a client-centric ESG investing experience

Read time 5 Minutes

In this post:

- The Sustainable Investing (SI) Experience Opportunity for Wealth Managers

- Essential Ingredients of a High-Quality SI Experience

- Results: Advocacy, AUM Growth and Referrals

The Power of a Client-Centric ESG Investing Experience

The Sustainable Investing (SI) Experience Opportunity for Wealth Managers

For all the focus on ESG investing, wealth managers don’t seem to be delivering high quality sustainable investing (SI) experiences to their clients. Only 1 in 6 clients who are interested in ESG receive a high-quality experience today. It’s a massive opportunity for wealth managers to deliver for the 5 in 6 who aren’t getting that experience. Those who do stand to reap handsome rewards in higher advocacy, AUM growth and referrals from their clients.

It’s one of the headline insights from ESG is Personal: A Global Study of ESG Preferences and Advisory Practices, an international study recently released by Capital Preferences. We surveyed 900 investors (300 each in the US, UK and Singapore) with financial advisors to understand their ESG knowledge and attitudes, and the quality of their sustainable investing experience to date. We also put each investor into Capital Preferences Sustainable Investing Simulator – a decision-science-based profiling activity – to map each investor’s ESG preferences in detail.

Essential Ingredients of a High-Quality SI Experience

If you’re an investor who is interested in ESG, what would you want from your investing experience with your advisor? As we constructed the study, we asked investors that very question. Here’s what we heard as the essential ingredients:

- A clear and committed advisor – investors want an advisor who they feel is committed to helping them invest sustainably, and who can clearly explain ESG concepts.

- High “preferences-to-portfolio” confidence – investors want advisors who help them discover what their sustainable investing preferences are and they want to be confident that their portfolio reflects those preferences. Remember, most investors are new to ESG, unsure what’s even possible with sustainable investing, and therefore uncertain of their own preferences to begin with! More on the preferences-to-portfolio gap in this blog post. Our view here is that revealed preferences profiling like that offered by the Sustainable Investing Simulator is central to the experience.

- A closed impact loop – to round it out, investors want to receive regular reports that give a clear understanding about the size of ESG impact of their investments, in terms that are meaningful to them.

That’s it. When you stand back and think about it, these ingredients make sense and they should be within reach for wealth managers to deliver. Yet, according to the ESG is Personal study, only 1 in 6 investors are getting an experience with all three of those essential ingredients today. That means 5 out of 6 (or over 80%) are not.

Results: Advocacy, AUM Growth and Referrals

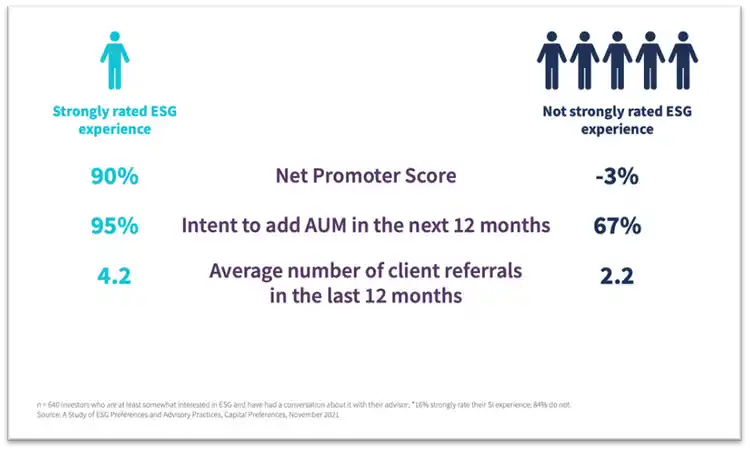

There’s a jaw-dropping difference in results between investors who do receive that high quality SI experience versus those who don’t. In the study, we asked investors a series of questions about their advisor relationship – ones that go to advocacy, intent to add AUM in the next 12 months, and number of referrals in the past 12 months.

When you compare the two populations, those who are getting a high-quality SI experience have Net Promoter Score ratings 90+ points higher (!), are much more likely to add AUM in the next 12 months, and report nearly double the number of referrals in the prior 12 months.

It represents a massive opportunity for wealth managers to elevate their ESG game, and take a client-first approach to designing a strong sustainable investing experience.