Foundations: risk tolerance and loss aversion

Read time 4 minutes

In this post:

- There’s more to understanding a client’s investment profile than just Risk Tolerance

- What’s the difference between Risk Tolerance and Loss Aversion?

- How to measure Risk Tolerance and Loss Aversion

There’s more to understanding a client’s investment profile than just Risk Tolerance

Managing risk as an advisor requires understanding each client’s risk preferences. However, common risk profiling approaches in use today often oversimplify risk preferences—there’s quite a bit more to the story.

There are two fundamental preference metrics to understand when pinpointing a client’s risk profile: Risk Tolerance and Loss Aversion.1

Risk Tolerance measures the portion of money an investor is willing risk losing for potential gains. Investors who have a higher risk tolerance are more comfortable in portfolios with higher volatility/return profiles. Economists measure Risk Tolerance using a parameter called CARA ρ (constant absolute risk aversion, rho), which calculates a user’s willingness to take investment risk.

Loss Aversion measures an investor’s sensitivity to losses, should they occur. Loss Aversion is independent of Risk Tolerance and is a critical component of understanding an investor’s complete risk profile. Economists measure Loss Aversion using a parameter called CARA α (constant absolute risk aversion, alpha), which calculates an investor’s sensitivity to loss based on how they alter risk-taking in relation to gains.

What’s the difference between Risk Tolerance and Loss Aversion?

While Risk Tolerance can cause clients to shy away from buying certain types of risky assets, Loss Aversion can influence client behavior when a portfolio loses value, leading to suboptimal outcomes.

Behavioral economics state that, for many individuals, “a gain contributes less to utility/happiness than an equal dollar loss subtracts from utility/happiness.”2 Because these individuals feel more pain from losses than satisfaction from gains of the same amount, a client’s Loss Aversion can cause them to sell off their equities when the market dips in order to halt the slide before they lose more, when, in actuality, investors with longer time horizons should be buying during those dips. Advisors with an accurate measure of their clients’ Loss Aversion will be able to know who these clients are in advance and engage them appropriately to manage those clients’ most harmful instincts.

How to measure Risk Tolerance and Loss Aversion

Loss Aversion is especially difficult to understand using Stated Preferences profiling methodologies. Clients do not know how to articulate how Loss-Averse they are, as separate from their Risk Tolerance. The only way to gauge both distinct metrics is to use Revealed Preferences diagnostics, which enable clients to show, rather than tell, advisors their complete risk profile.

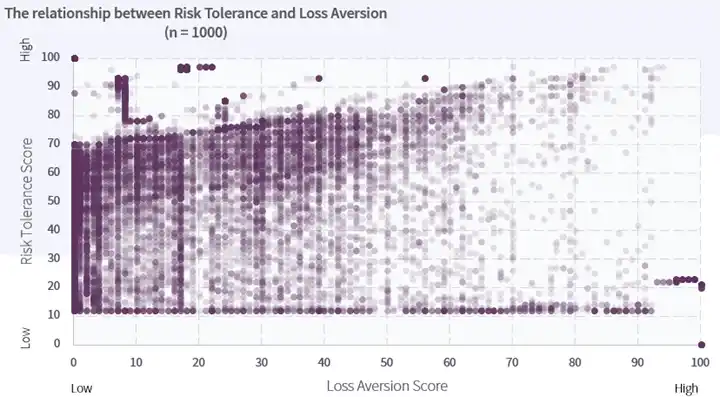

We have conducted studies around the globe calculating the Risk Tolerance and Loss Aversion of thousands of investors using revealed preference risk profiling tools. In our data below, you’ll notice there is a wide distribution of investor preferences across the Risk Tolerance and Loss Aversion spectrum:

Every client is unique. Just because a client is highly Risk-Tolerant does not mean the client can’t also be highly Loss-Averse. Risk Tolerance and Loss Aversion must both be rigorously understood for a holistic and personalized investment plan to be possible, as well as for predicting client behavior during different market conditions.

To learn more about the different methodologies utilized for calculating Risk Tolerance and Loss Aversion, check out our two-part blog series on Stated vs. Revealed Preferences.

[1] There are, of course, other relevant factors that must be considered, such as the investor’s goals and the level of risk necessary to achieve said goals within the desired time horizon, as well as the investor’s risk capacity, which gauges how much risk an investor can afford to take. However, neither of these are “preference” metrics – they refer to an investor’s goals and constraints, which we will cover in a future Foundations post.

[2] https://www.hartfordfunds.com/investor-insight/risk-aversion-vs-loss-aversion.html