The leading global fintech dedicated to understanding clients.

.webp?u=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fgbxcsezf%2Fproduction%2Fe581f22df1b5b40beedaa78b35f8c7324387aefa-2930x1572.png&a=w%3D750%26h%3D402%26fm%3Dwebp%26q%3D40&cd=e804251e83706a58c6818579313370bf)

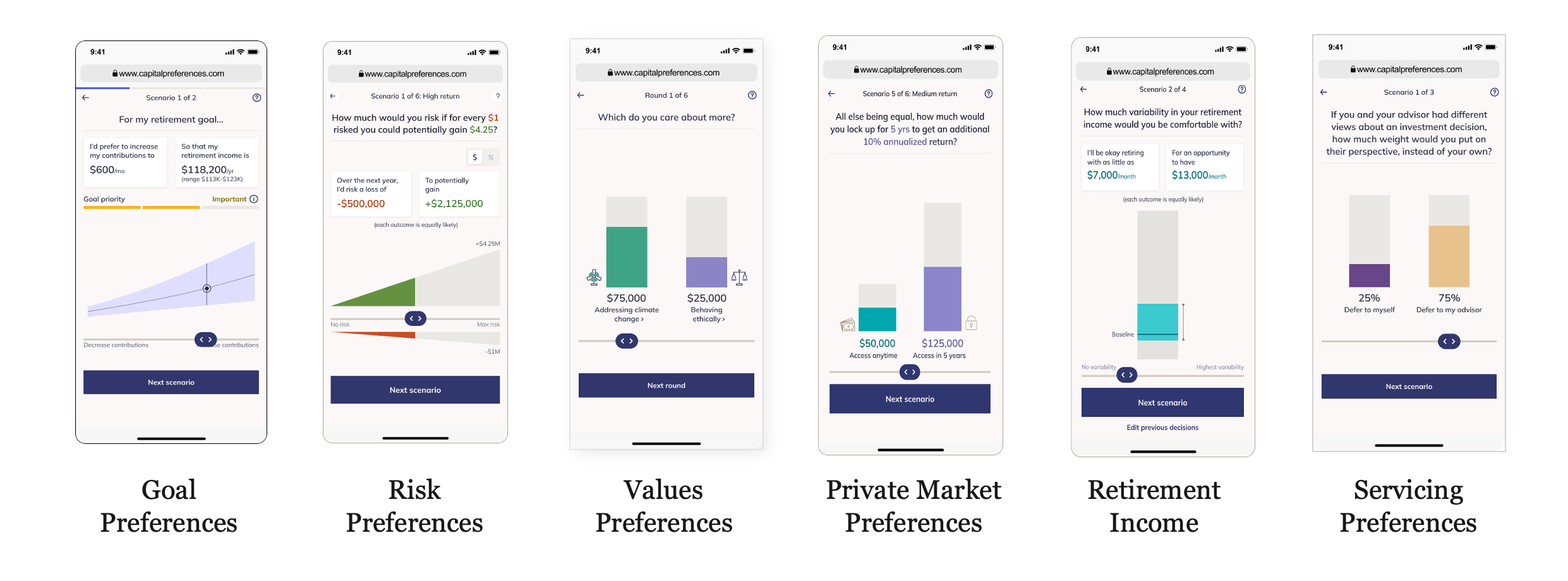

Our internationally validated client discovery methods engage clients, build interest, and drive personalized investment solutions, at scale.

We create better outcomes because clients are understood, aligned, and educated.

.webp?u=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fgbxcsezf%2Fproduction%2F9af956d2d4b6ccdd8b9e6155f10fca78e9a70464-1860x676.png&a=w%3D750%26h%3D273%26fm%3Dwebp%26q%3D40&cd=f0c960578968b029dc5be422e6edb173)

Data for AI Applications

The Economic Fingerprint® Dataset is fueling AI-powered, personalized financial advice, at scale.

.webp?u=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fgbxcsezf%2Fproduction%2Ffc22bc76ce0435bbd0e60afdd489fde6b4e16dd2-1514x1422.png&a=w%3D750%26h%3D704%26fm%3Dwebp%26q%3D40&cd=a24874cd4e92faeb8f4eb123d78c9e7f)

Understanding client decision making is science, not art.

The world's leading research team in the science of understanding investor decision making.

.webp?u=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fgbxcsezf%2Fproduction%2F10691141cb1f7681e9fa3b4379511c38d932e546-1246x1764.png&a=w%3D750%26h%3D1062%26fm%3Dwebp%26q%3D40&cd=4aeb60abc245efbde4126df9dc2b4bc7)

.webp?u=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fgbxcsezf%2Fproduction%2F4d33d8c57a073e1cd53bff5491d7180a0005d65e-1270x1424.png&a=w%3D750%26h%3D841%26fm%3Dwebp%26q%3D40&cd=e27ff14eb9a34f34643ba71a8fa60ae5)