Foundations: stated vs. revealed preferences – part 1

Read time 5 minutes

This is the first in our Foundations series of blog posts. The goal of the series is to cover some of the key classical and behavioral economic building blocks, and how they play out in understanding clients more deeply in an advice context.

This post is a two parter—the first part covers the problems with prevailing “stated preferences” client profiling approaches. The second part introduces “revealed preferences”, the method at the heart of the next generation of client profiling solutions.

In this post:

- RTQ’s and investor interviews are insufficient for understanding a client’s investment profile

- The fundamental limitations of Stated Preference client profiling methods

Part I: RTQ’s and investor interviews are insufficient for understanding a client’s investment profile

The two pillars of financial advice are the ability to understand clients in all of their complexity and the ability to construct a suitable portfolio and plan to meet their needs. Each pillar is essential, but only one, portfolio management, has benefitted from modern mathematics and computing techniques.

Today, portfolios are constructed with scientific precision to manage risk and deliver personalized outcomes based on the client’s investment preferences. In contrast, firms still employ qualitative and inaccurate methods for profiling clients, despite increasingly complex client preferences and priorities. If the client profile underlying a portfolio does not accurately reflect the client’s actual preferences, goals, and constraints, then clients will ultimately end up with portfolios that are unsuitable for them. This is a monumental problem.

The fundamental limitations of Stated Preference client profiling methods

Profiling methods vary, but their thrust is to understand and measure a client’s:

- Preferences (risk tolerance) – real world, financial choices a client would make if they truly understood the available options and had time to thoroughly consider them.

- Goals (risk requirements) – a client’s primary intentions for their financial assets

- Constraints (risk/loss capacity) – a client’s capacity to pursue various goals, driven by age, income, assets, tax policy, and other considerations

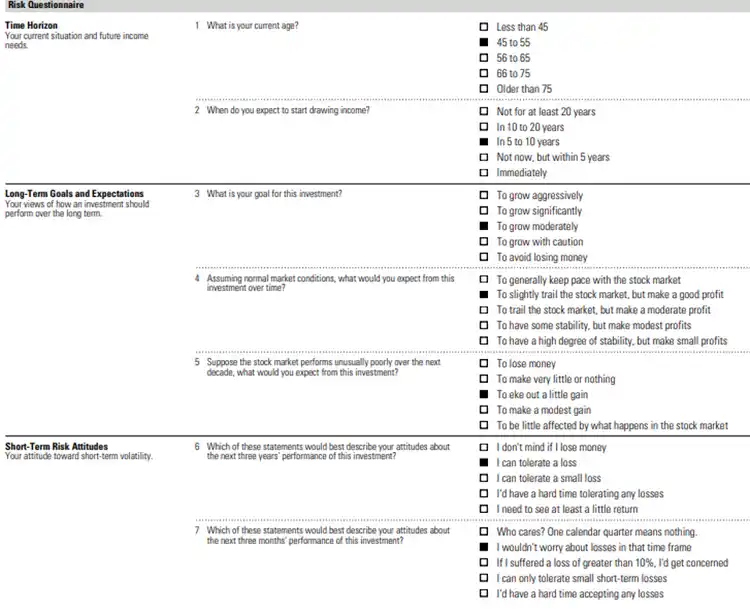

Historically, advisors have used investor interviews and/or risk tolerance questionnaires like the one shown below to assess client goals and to profile their preferences and constraints:

The results these methods produce are imprecise, incomplete, and infrequent. Investor interviews and risk tolerance questionnaires rely on ambiguous language with no underlying mathematical theory supporting their scoring methods or definition of risk, making them:

- Unreliable – Results will vary, depending on the questions asked or even how standard questions are interpreted by investors, resulting in varying advice for that same client.

- Difficult to validate – Without precise language and mathematical theory as a core underpinning, defending the suitability of the advice provided is problematic.

- Difficult to interpret – Questions like “On a scale from 1 to 5, how comfortable are you with uncertainty when investing?” are very difficult for investors to accurately answer.

A fundamental limitation of these methods is their reliance on stated preferences, which assume that people can accurately state their own preferences and priorities. Economic research makes clear, however, that many investors face enormous difficulty articulating their preferences for risk or otherwise.

As a result, financial advisors who use these unscientific methods often work with poorly defined and unverifiable information. The resulting advice may therefore be badly misaligned and hard to validate as compliant or suitable. As an industry whose business processes have serious impact on financial and personal well-being, profiling assessments should be grounded in precise measurements, not just words, with a consistent scoring methodology and statistical confidence in the results we gather from clients.

Without scientific confidence in the assessment results of client preferences and priorities, the credibility of the advice process and claims of “customization” and “personalization” are inherently weak. Additionally, both investor interviews and risk tolerance questionnaires don’t work well in a digital age, where more and more consumers will be acquired and served online.

The Stated Preferences method is one-dimensional, focused purely on risk, and does not:

- Provide the advisor with any degree of confidence regarding the reliability of the profile itself; the advisor can’t be certain they captured the client’s true preferences.

- Provide quantitative guidance on specifically how an investor’s naturally occurring preferences might translate into a portfolio allocation.

- Offer quantitative guidance on other key dimensions of willingness to accept risk including, loss aversion, ambiguity aversion, goal priorities, and time preferences.

In Part 2, we take a look at revealed preferences as an alternative – and more scientific – approach to client profiling.