Is your advice process failing women?

Read time 5 Minutes

In this post:

- The problematic ways couples are risk-profiled, if at all

- Advisors are using imprecise methods to risk-profile couples

- Listening to both partners equally is the difference between gaining and losing AUM

- How to deliver a strong risk readout

The problematic ways couples are risk-profiled, if at all

Most advisors manage assets held by couples rather than individuals. Too often, however, advisors do a poor job of incorporating both partners’ preferences in the financial planning process. The neglected partner is also usually the woman in the couple.

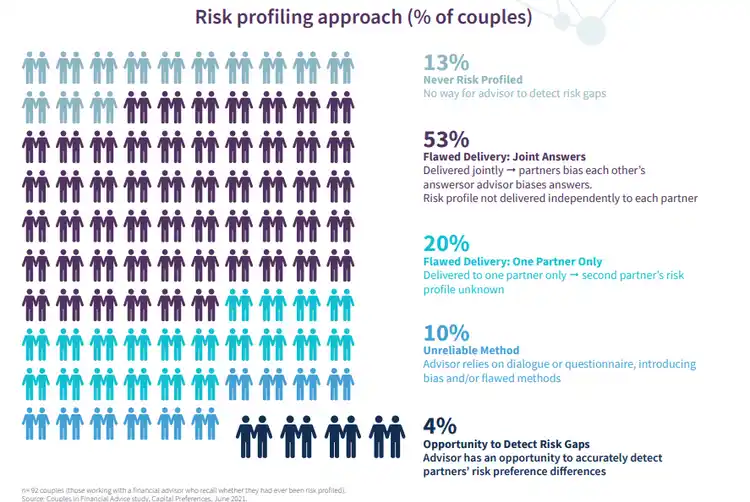

This unacceptable trend of neglecting one partner is perhaps demonstrated best in the industry’s current approach to risk profiling couples. Today, 20% of advisors only risk profile one person in the couple.

Additionally, 53% risk profile the partners jointly, where both partners weigh in on a single risk profile. This approach is highly prone to the partners biasing each other’s answers and advisor bias, as the male is still the primary financial decisionmaker in 33% of American couples.1 This potentially creates situations where one partner (often the woman) is overlooked, either wittingly or unwittingly.

Advisors are using imprecise methods to risk-profile couples

To make matters worse, most advisors still use Stated Preferences methods of risk profiling – such as questionnaires or dialogue – which are especially prone to bias and imprecision.

We conducted a study where we risk-profiled members of couples individually using Revealed Preferences methods. This decision science-based method allowed us to uncover fuller and more accurate contours of risk preferences among couples, along with implications for advisors.

Listening to both partners equally is the difference between gaining and losing AUM

What we found is that 60% of couples have meaningful differences in risk preferences. These couples are an asset flight risk to advisors. They are six times as likely to decrease AUM compared to couples in the same risk quintile [ii]. We speculate that couples with larger risk gaps have at least one partner who doesn’t feel comfortable with the way their assets are currently invested, which feeds through to intent to move AUM.

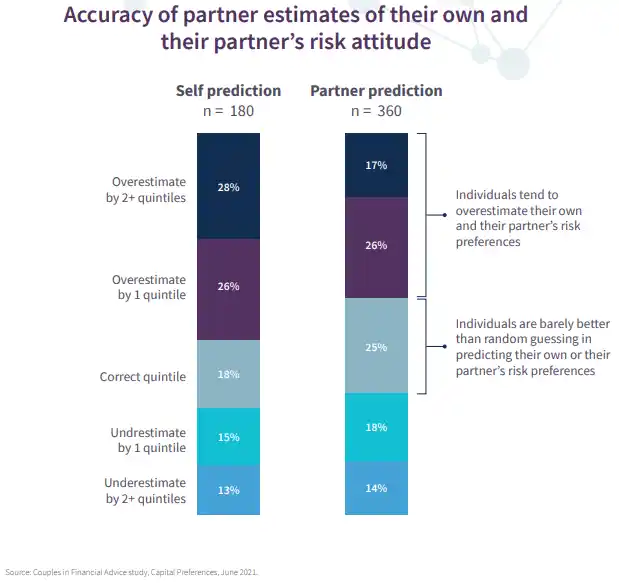

Moreover, the partners were not good at predicting their own or their partner’s risk attitude. Consequently, advisors who use risk tolerance questionnaires or dialogue to measure their clients’ preferences are on very shaky ground, no matter how keen they judge their own sense of “reading” clients.

As a result, most advisors are flying blind when it comes to detecting risk preference gaps and the AUM risk that comes with it. It’s a costly mistake, both financially and ethically, for advisors to make.

Given that the divorce rate in the United States is 50%, and 43% of individuals switch financial advisors after a divorce,3 the risk of client churn is high for advisors not engaging and understanding both partners’ preferences equitably.

This also presents a massive upside opportunity for advisors who re-think the risk profiling experience for couples. Advisors who can efficiently engage, understand, and enfranchise each partner set themselves up to create shared, memorable advice moments with the couple. These moments are the key to building strong relationships with the second partner, who is most often a woman, well before potential divorce events occur.

To unpack this opportunity, we measured the quality of risk readout couples received from their advisors. A quality risk readout includes the following:

- Clients have high confidence that the risk profile accurately accounts for each partner’s individual risk attitudes

- Advisor provided a very clear explanation of the results

- Advisor facilitated an insightful discussion about what each partner’s risk attitude means for their combined investments and/or financial plan

- Advisor helped the couple reach a consensus on a shared risk profile that fairly accounts for each partner’s individual risk attitudes

- Advisor used the risk profile activity to point out insights about differences and similarities between partners that they found highly valuable

Couples who BOTH reported high scores on these dimensions we designated as receiving a high-quality risk readout – one that is well understood, insightful and equitable. We then looked at a range of advisor relationship strength indicators, as reported by the clients. For those receiving a high quality risk readout, the differences are stark.

Advisors delivering a strong risk readout to couples have a 40-point NPS lift, 23% greater intent to grow AUM, and 35% lift in value for fees paid than those delivering weak risk readouts.4

How to deliver a strong risk readout to couples

The key to a strong risk readout is to profile each partner individually and equitably using Revealed Preferences methods, such as Capital Preferences’ Risk Advisory Experience, to scientifically understand their risk preferences. Because Revealed Preferences methodology is grounded in decision science, advisors can combine the individual members of a couple’s risk preferences to get a mathematically optimal preference and portfolio mapping for the couple together.

This way, the advisor and couple can have a collective conversation about how to best accommodate both partners’ preferences to achieve their financial goals together. These are the active ingredients in re-thinking risk profiling to create memorable (and equitable) advice moments for couples.

It’s past time the advice industry take a closer look at how its existing advice journey treats women in a couples context. New methods and technology, like Revealed Preferences, create the opportunity for advice firms to address the inequity, and do good for their business at the same time.

Works Cited:

- [1] Capital Preferences: Not-So-Odd Couples: A Study of Partners’ Risk Preferences, Crafting an Equitable Client Journey for Modern Couples

- [2] Ibid.

- [3] 10 Disruptive Trends in Wealth Management, Deloitte, 2020

- [4] Capital Preferences: Not-So-Odd Couples: A Study of Partners’ Risk Preferences, Crafting an Equitable Client Journey for Modern Couples