The social currency of a personalized ESG investing experience

Read time 5 min

In this post:

- Uncovering an investor’s ESG Fingerprint

- Enhance your firm’s social currency and attract new clients

Uncovering an investor’s ESG Fingerprint

Individual investors the world over are having ESG epiphany moments, realizing they can align their investments to their values and make a positive impact on the sustainability perils that surround them.

According to our recent ESG is Personal: 2022 Global Study of ESG Preferences and Advisory Practices, 68% of investors in the United States, United Kingdom, and Singapore rate ESG factors as Important or Very Important in their investing decisions. The pivot towards ESG, especially among Millennial and Gen-Z investors, presents a massive opportunity for wealth managers to increase AUM and enhance their firm’s brand.

As part of our research, we had 900 investors complete our Sustainable Investing Simulator to reveal each individual’s unique ESG Fingerprint. The ESG Fingerprint comprises several key parameters:

- Altruism score – reflects how investors trade off their own (and family’s) wellbeing vs. the wellbeing of society at large. This can be used to gauge how much value an investor places in ESG investing.

- Theme weighting scores – a utility score that shows the degree to which an investor demonstrates conviction for each ESG theme (climate change, basic needs, ethical behavior, etc.)

These mathematical parameters are combined to construct portfolios that include a tailored, utility-maximizing mix of ESG investments for each investor’s sustainable investing preferences.

In the example results below, you can see that every investor’s ESG Fingerprint is unique, with differing levels of altruism and theme weighting:

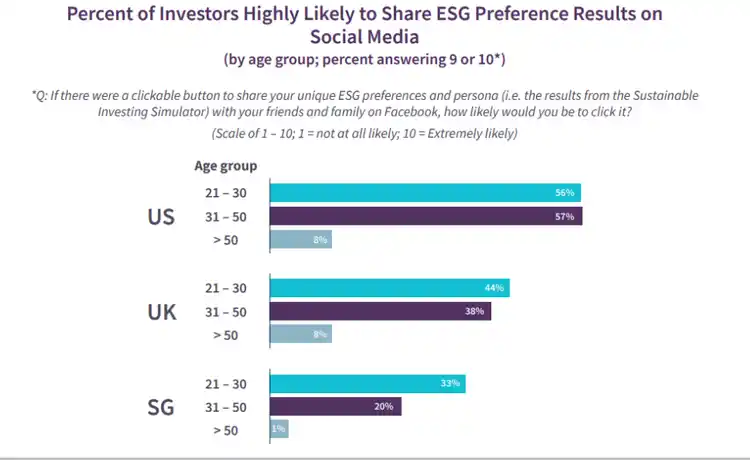

After completing the activity, we asked participants how likely they would be on a scale from 1-10 to share their ESG Fingerprint results on social media. What we found is that more than half of American Millennial and Gen-Z participants would share their ESG Fingerprint results on social media, with large portions of British and Singaporean investors also following suit.

Enhance your firm’s social currency and attract new clients

This presents a free and organic marketing opportunity for advisory firms. While clients do not generally post on social media about their wealth managers, when it comes to ESG, our study indicates that they want to share their sustainable investing persona with their networks. Clients want to promote that they are committed to investing sustainably and find social currency in sharing their ESG Fingerprints with family, friends, and colleagues.

ESG investing presents a new form of social currency for firms. Clients who share that their wealth manager helped them discover and incorporate their sustainable investing profiles into their financial plans bolsters the brand value of that firm. Clients who receive a strong ESG investing experience are also more likely to promote their advisors, add AUM, and directly refer their friends and colleagues.

Firms that can deliver accessible and personalized ESG client experiences will gain not only the social currency of being associated with sustainability initiatives, but will also capture the wallet share of Millennial and Gen-Z investors as they hit their peak earning and investing years in the not-too-distant future.