The ESG preferences-to-portfolio gap is real

Read time 5 minutes

In this post:

- The ESG Preference-to-Portfolio Gap

- Investors’ ESG Preferences are Highly Individualized

- How to Close the Gap

The Perils of Today’s Portfolio Personalization with Yesterday’s Client Diagnostics

Would it shock you to learn that over half of investors have a portfolio that is misaligned to their ESG preferences? It highlights a clear opportunity for advisors and wealth managers to re-think the sustainable investing experience they deliver to their clients. And it’s one of the key findings from Capital Preferences’ recent study, ESG is Personal: Global Study of ESG Preferences and Advisory Practices, which studied over 900 investors who work with financial advisors in Australia, Hong Kong, the Netherlands, Singapore, the UK and the US.

We know that interest in ESG among retail investors is on the upswing. 68% of investors say that ESG factors are important or very important in their investing. The pandemic, plus the constant drumbeat of “E” and “S” news headlines, surely are among the driving factors.

At the same time, we discovered that only 25% of investors are confident their portfolio fully reflects their values.

That’s a wide gap.

It reflects a confusing ESG landscape for investors (and the advisors who serve them), full of overlapping terms and concepts, along with an absolute flood of information and product choice. It’s no wonder retail investors are unsure of their ESG preferences, and lack confidence their portfolio reflects their values.

The very first thing we found in studying the preference data? ESG preferences are highly individualized. I’ll save the nitty-gritty details on that for another blog post (or read more about it in the study).

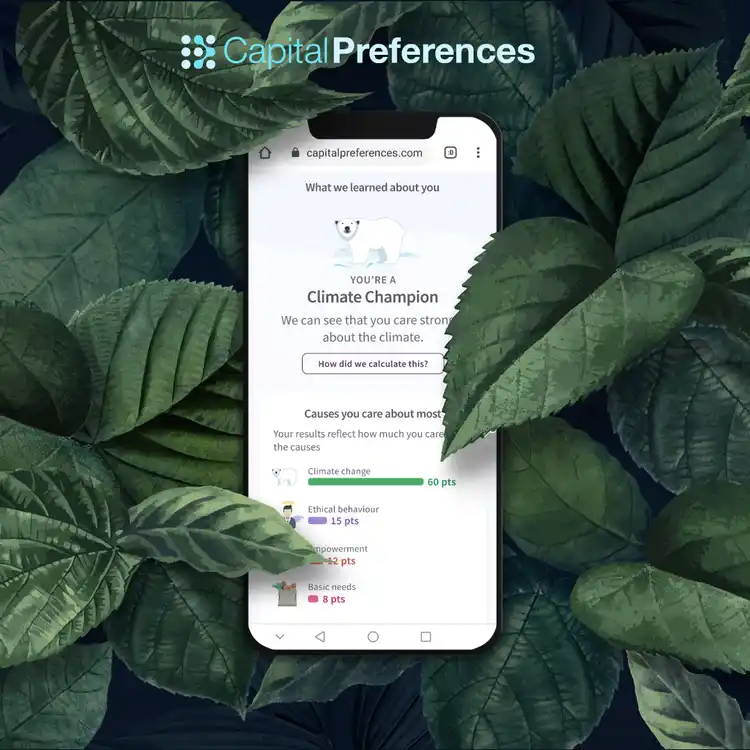

For now, think of each investor as having a unique “Sustainability Fingerprint”, which includes measurements of their:

- Altruism score – how they trade off their own (and their family’s) wellbeing against the wellbeing of society at large

- ESG theme weighting scores – their preference and level of conviction for each of 5 ESG themes we tested (Basic Needs, Climate Change, Natural Capital, Ethical Behavior, Empowerment)

We were then able to compare these precise measurements of ESG preferences against the stated portfolio composition for each investor.* And that’s where we found that 55% of investors have a portfolio that is misaligned to their ESG preferences.

While there’s a variety of ways such a preference-to-portfolio mismatch could present, the two most common ones we saw in the data are as follows:

- The investor’s revealed preferences show a clear preference for one of the five ESG themes, but their portfolio is weighted toward a different theme.

- The investor’s revealed preferences show roughly equal weighting across the five ESG themes, but their portfolio is weighted to a specific theme.

How to Close the Gap

What to do about the mismatch?

First, know thy client. Advisors should consider adopting diagnostic tools that can educate clients (without overwhelming them), and then detect each client’s individual ESG preferences. When advisors (and their clients) feel they have a clear and precise understanding of their ESG preferences, they can construct portfolios that align tightly to those preferences. That’s the key to bringing that 55% mismatch number down, and boosting client (and advisor!) confidence along the way.

Beyond that, the study revealed a few other important factors in the broader sustainable investing experience. I’ll dedicate another blog post to that larger picture, which surely demands that advisors and wealth managers think “clean sheet” about the sustainable investing experience they deliver to clients.

Be in touch at insights@capitalpreferences.com or request a demo.

Investors’ ESG Preferences are Highly Individualized

That’s why the centerpiece of the ESG is Personal study is a deep dive discovery of investors’ ESG preferences, using an award-winning method grounded in decision science.

We used Capital Preferences’ Sustainable Investing Simulator with the 900 study participants. The Simulator does a bit of light ESG education and puts investor preferences under a microscope using a “revealed preferences” method. More on that in the video below, for the curious among you. The key thing to understand is, rather than asking investors to tell us their ESG preferences, we had them make a series of tradeoff decisions and used mathematics to “recover” their preferences.