Foundations: understanding social preferences

Read time 5 minutes

In this post:

- What are Social Preferences?

- The Implications of Social Preferences for Wealth Managers

- How to Understand your Clients’ Social Preferences

What are Social Preferences?

One of Life’s Three Key Tradeoffs is choosing whether to allocate resources toward your own wellbeing or toward the wellbeing of others. Economists define this tradeoff between self and others as one’s Social Preferences.

A person’s Social Preferences have rippling societal effects – from which political candidates they vote for, to what career they choose, to their lifestyle and consumer choices. For example, studies show that policy elites1 and future physicians2 in the United States making this tradeoff are far less inclined than the average American is to sacrifice efficiency (self) to promote equality (others).

For any business, a rich understanding of customer Social Preferences unlocks personalized product and service offerings that align with the customers’ values. For wealth managers, understanding clients’ social preferences is pivotal to retaining and capturing the walletshare of clients over the next decade.

The Implications of Social Preferences for Wealth Managers

Social Preferences impact financial advice – historically, this was most clearly demonstrated in estate planning decisions (whether and how much clients want to bequest) and retirement decisions (whether clients are relying on themselves, their family, or the state to care for them). Today, Social Preferences are increasingly important with the rise of ESG and values-based investing.

Client demand is surging across all wealth levels for bespoke investment advice that achieves both the clients’ financial goals while also investing in a way that aligns with the clients’ values. Investors the world over are awakening to the importance of sustainable investing goals – 65% of investors now view ESG factors as important or very important in their investing.3

We are also in the midst of a $30 trillion intergenerational wealth transfer from Baby Boomers to their children. Eighty percent of clients who inherit wealth will look for a new advisor, and these clients – mostly Gen-Xers and Millennials – have high interest in ESG.

This presents a massive inflection point for the industry – a generational opportunity for first movers who can capitalize on understanding their clients’ social preferences and deliver personalized advice at scale.

How to Understand your Clients’ Social Preferences

Today, most wealth managers utilize Stated Preferences methods for understanding their clients’ Social Preferences. In other words, they rely on advisor-client dialogue or use questionnaires that offer binary selections for favored ESG causes and exclusions. These approaches provide scant insights on the breadth, depth, or relative importance of investors’ ESG preferences, while also offering a lackluster client experience.

To understand with precision how much of a client’s portfolio should be invested in ESG vs. traditional funds, or how much a client cares about addressing climate change vs. supporting people’s basic needs, a more scientific method of understanding Social Preferences is needed.

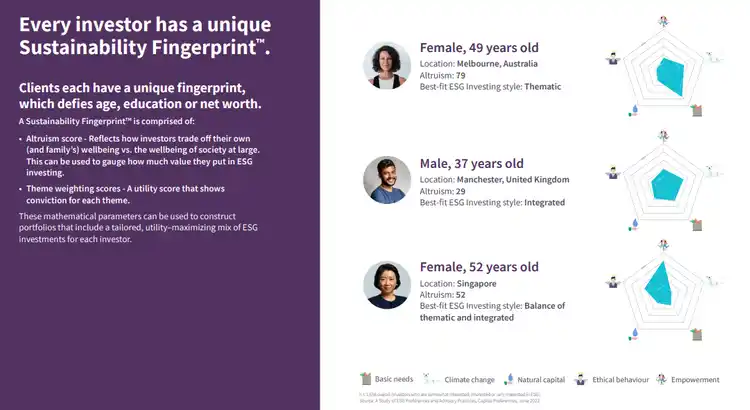

This is where Revealed Preferences methods bridge the preferences-to-portfolio gap. Our Sustainable Investing Simulator, for example, lets us measure each client’s altruism, sustainable investing style preferences and sustainable theme preferences. Together, these preferences form a client’s Sustainability Fingerprint – the unique collection of preferences associated with each client.

In our

ESG preference data can be combined with ESG ratings data from any of the major providers to calculate a Sustainability Match Score that measures how closely the ESG characteristics of an investment product match the sustainability preferences of an investor.

This “preference-to-portfolio” alignment is the centerpiece of a high-quality sustainable investing experience for clients. From our research [v] the difference between delivering a high-quality vs. average ESG client experience leads to substantial differences in NPS, AUM, and client referrals.

Social Preferences are a key part of the rich preferences fabric that describe each client. Advances in client diagnostics are now letting the industry build a deeper understanding of each client, enabling personalized advice at scale and a more meaningful client experience. Rather than make assumptions about client preferences, it is best to use methods that are tuned to detect each investor’s individual preferences—especially when personalizing plans and portfolios is the objective.

Works Cited:

[i] The Distributional Preferences of an Elite – Raymond Fisman, Pamela Jakiela, Shachar Kariv, Daniel Markovits

[ii] Social Preferences of Future Physicians – Jing Lia, William H. Dowb, and Shachar Kariv

[iii] Capital Preferences – 2022 Global Study of ESG Preferences and Advisory Practices

[iv] ibid.